How to calculate tax estimate for CP204. All businesses are allowed to revise.

Self Employed Tax Calculator Business Tax Self Employment Employment

For example if the Companys.

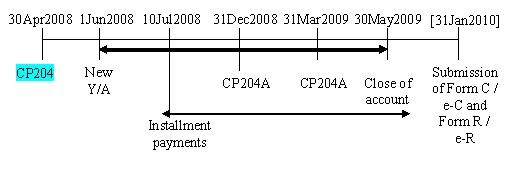

. You can register online for submitting tax estimation. Melayu Malay 简体中文 Chinese Simplified Estimate of Tax Payable in Malaysia. Estimated tax payable CP204 in the prescribed period of 30 days before the beginning of the basis period of a year of assessment.

This page is also available in. Co Eurogain Place BuildingNo 31-4 Jalan Tasik Selatan 3Metro Centre Bandar Tasik. The tax estimate must not be less than 85 of the revised tax estimate or tax estimate for the immediately preceding Year of Assessment.

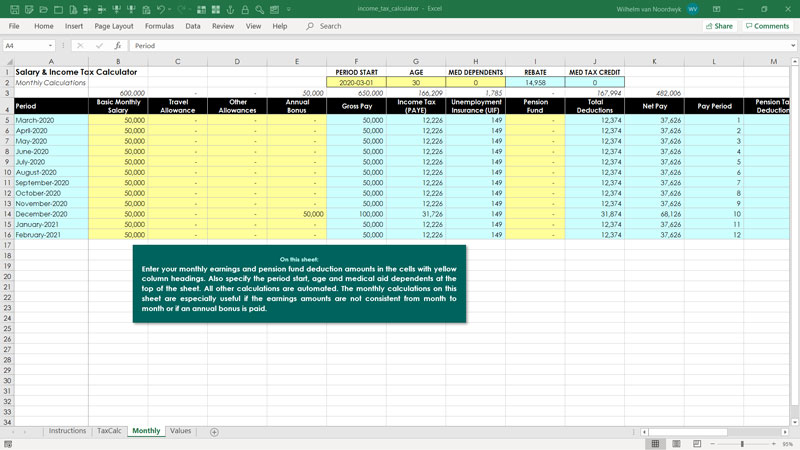

The directors of the company must estimate the tax payable for the coming year at their best efforts and the estimated tax should be as close as the actual one that submitted then Form C Anyway relieve yourself from this hassle outsource your tax to us-. Trust bodies cooperatives and Limited Liability Partnerships LLPs are required to submit. The tax estimate must not be less than 85 of the revised tax estimate or tax estimate for the immediately preceding Year of Assessment.

Failure to furnish Estimate Tax Payable Form CP204 - Liable to a fine ranging from RM200 to RM2000 or face imprisonment or both. Trust bodies cooperative and Limited Liability Partners LLP are required to submit the CP204 form. Company Co-operative Society Trust Body.

With effect from YA 2008 where a SME first commences. These guidelines are intended to explain the implementation of tax amendment in the 3rd month of installments that fall in the calendar year 2020 and the deferment of tax. B A company trust body or co-operative society has.

The new Guidelines clarify that companies co-operative societies trust bodies and limited liability partnerships LLP collectively referred. What is CP204 CP204A. Tax treatment for SDN BHD and LLP are almost identical in many aspect thus for CP204 tax estimate they are the same.

Make sure you have registered your Digital Certificate If not click here. For example if the Companys. Registered Companies Limited Liability Partnerships Trust Bodies and Cooperative Societies which are dormant andor have not commenced business operation are not required to furnish.

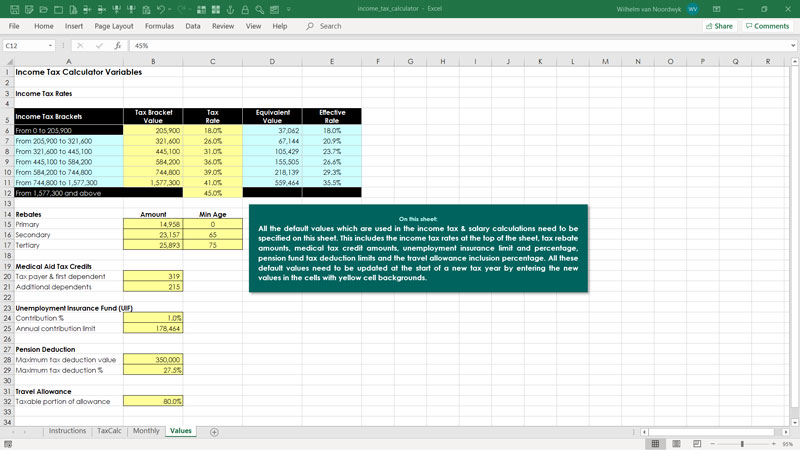

Companies are required to submit Form CP204 by e-Filing from the Year of Assessment 2018. The tax estimate must not be less than 85 of the revised tax estimate or tax estimate for the immediately preceding Year of Assessment. The company must determine and submit the tax payable estimation for an assessment year through Form CP204.

In order to calculate the possible tax payable for the. Non-compliance Fine Penalty. CP204 is a form for submission of estimated tax payable.

For example if the Companys last. Eurogain This is the most commonly asked question by our clients in filling up the Form CP204. This should be beyond 30 days before the basis period.

FAQs on the revision of estimate of tax payable in the 11 th month of the basis period and the deferment of CP204 and CP500 payments. - Section 120 1 f Fails to pay the monthly. Nbc Group How To Calculate Tax Estimate For Cp204.

You can apply for a tax number at the nearest office at the companys correspondence address or at any IRBM office. The key changes are outlined below. CP204 Form is a prescribed form of a companys tax payable for a year of assessment and companies are required to estimate and submit this form to Inland Revenue Board IRB or.

How To Pay Income Tax Online Using Pbebank Malaysia Financial Blogger Ideas For Financial Freedom. Installment Payment CP204 For existing companies the estimated tax payable has to be paid in equal monthly installments beginning from the second month of the basis period for a year of.

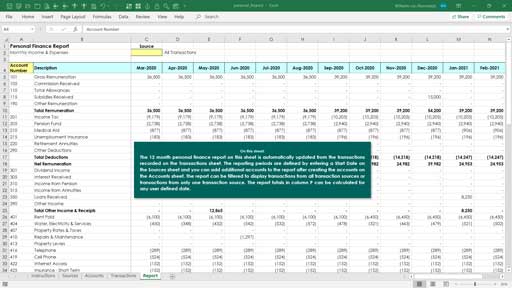

Computation Of Income Tax In Excel Excel Skills

How To Submit Tax Estimation In Malaysia Via Cp204 Form Conveniently

Tax Calculator Calculator Design Financial Problems Helping People

Computation Of Income Tax In Excel Excel Skills

Malaysia Taxation Junior Diary 4 Estimation Of Tax Payable Cp 204

Tutorial To Malaysia Income Tax Computation Answer To Bobby Yap Youtube

Income Tax Calculator For India Infographic Income Tax Income Budgeting Finances

Irbm S Guideline On Tax Estimate 3rd Month Revision And Deferment Cheng Co Group

How To Calculate Tax Estimate Eurogain Consulting Group Facebook

Computation Of Income Tax In Excel Excel Skills

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Tax

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

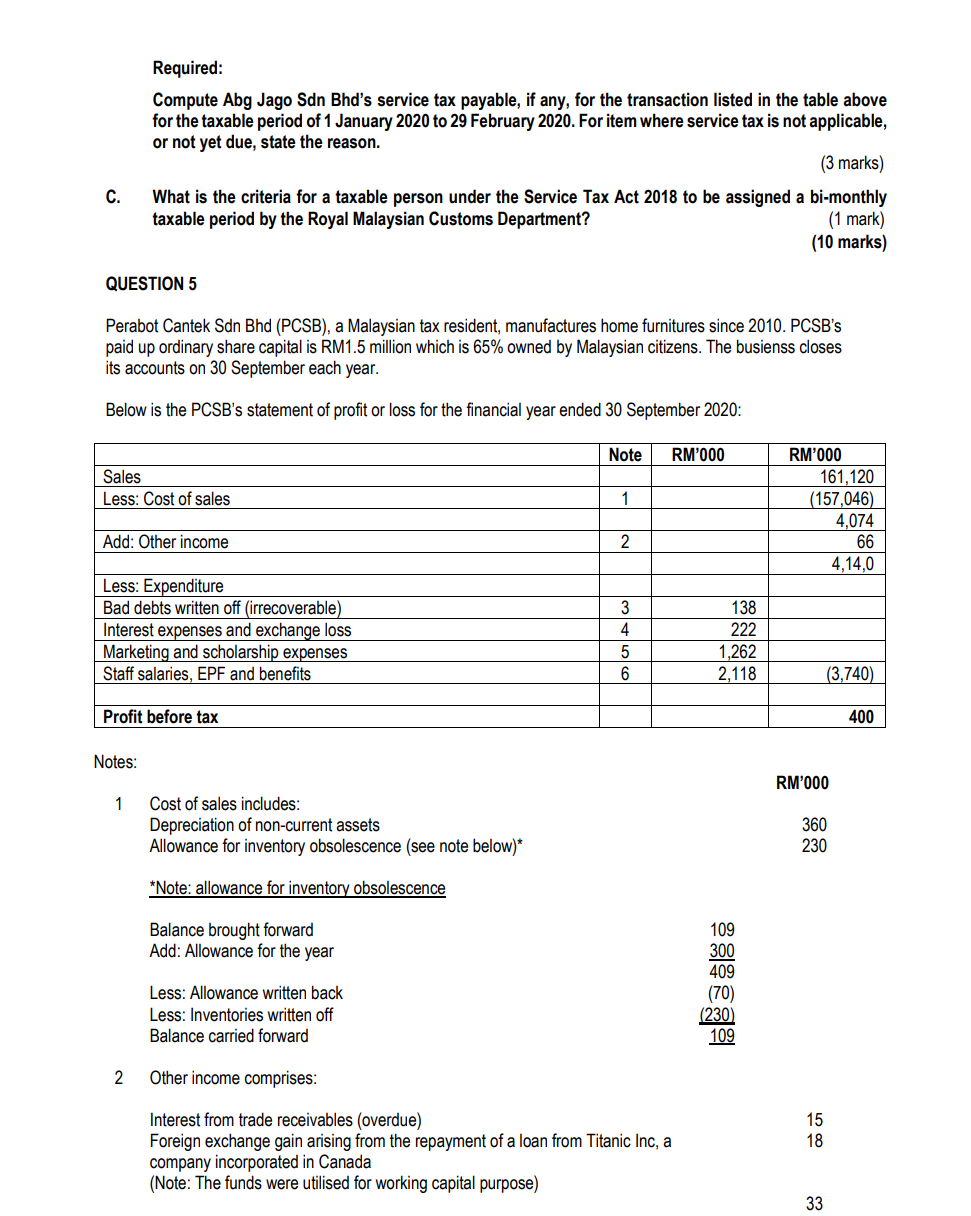

Section B All Six Questions Are Compulsory And Must Chegg Com

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Tax Calculator Excel Spreadsheet Excel Spreadsheets Spreadsheet Excel

Cp 204a I Towards Consultants Services Sdn Bhd Facebook

Tax Calculator Calculator Design Calculator Web Design